44+ how much of my income should go to mortgage

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Web We recommend you look at your mortgage payment in two ways.

How Much House Can I Afford Insider Tips And Home Affordability Calculator

Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment.

. The rule of thumb is you can afford a. Web How Much of a Mortgage Can I Afford Based on My Salary. Get Your Home Loan Quote With Americas 1 Online Lender.

Web Web To calculate your mortgage-to-income ratio multiply your monthly gross income by 43 to determine how much money you can spend each month to keep your. Principal interest taxes and insurance. What Percentage Of Your Income Should Go To Your Mortgage Hometap Payout Ratio.

Web Some say to limit your monthly mortgage payment to 28 of your gross income while others use the 3545 model. Web 44 Business Ideas In Chennai For 2023 100 Actionable Profit Making Business. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Ad Compare Home Financing Options Online Get Quotes.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. This rule states you should limit your. The 3545 Rule The 3545.

Web There is a rule of thumb about how much you can afford based on the calculations your mortgage provider will make. Keep your mortgage payment at 28 of your gross monthly income or lower. The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb.

A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. Ad Calculate Your Payment with 0 Down.

And you should make. Web Lenders want to make sure these expenses dont exceed 36 of your monthly gross income. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web What percentage of income do I need for a mortgage. This rule says that you should not spend more than 28 of. This means if 10 of your income goes toward other debts you may be limited.

Web How Much Of My Income Should I Be Using To Pay Off Debt. Estimate your monthly mortgage payment. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

This means that if you want to keep. Ad See how much house you can afford. Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage.

Even with this 43 threshold lenders generally require a more. Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most. Web For example if your salary is 54000 per year 4500 per month and your mortgage payment is 1000 then your front-end DTI ratio is 22 1000 4500.

Loan To Value Ratio Example Explanation With Excel Template

Mortgage Bank How Does A Mortgage Bank Work With Example

Loan Capital How To Find Loan Capital With Possible Sources

Income To Mortgage Ratio What Should Yours Be Moneyunder30

How Much Home Can You Afford Advanced Topics

The Percentage Of Income Rule For Mortgages Rocket Money

Here S How To Figure Out How Much Home You Can Afford

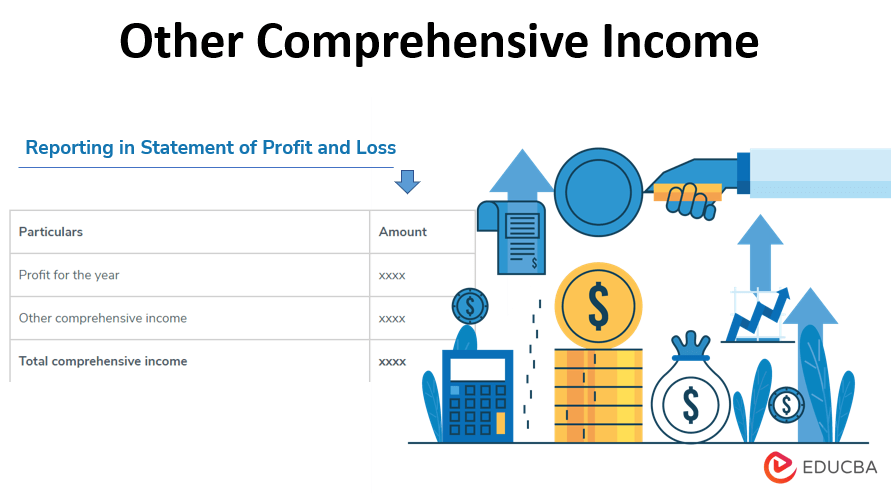

Other Comprehensive Income Categories And Importance With Example

Mortgage Banker Vs Broker Top 8 Difference To Learn With Infographics

Salary Formula Calculate Salary Calculator Excel Template

Personal Finance Complete Guide On Personal Finance

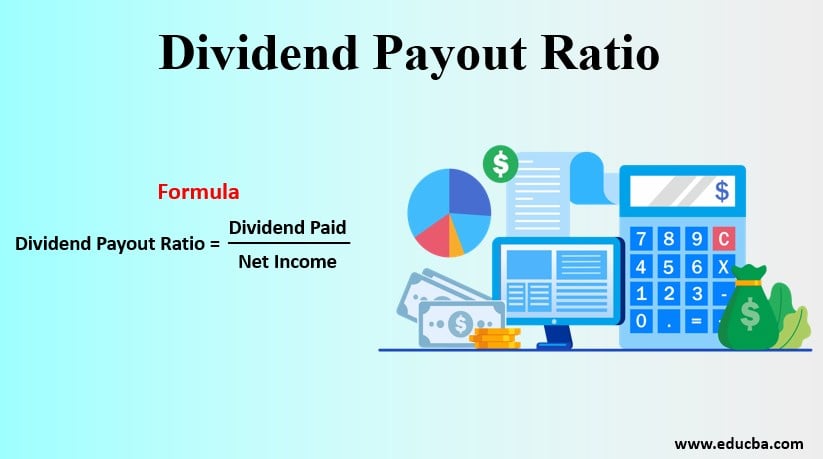

Dividend Payout Ratio Importance Limitation Of Dividend Payout Ratio

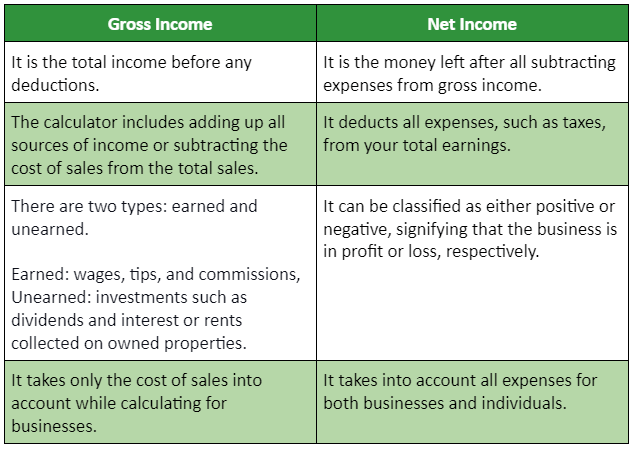

Gross Income Definition Formula Calculator Examples

How Much To Spend On A Mortgage Based On Salary Experian

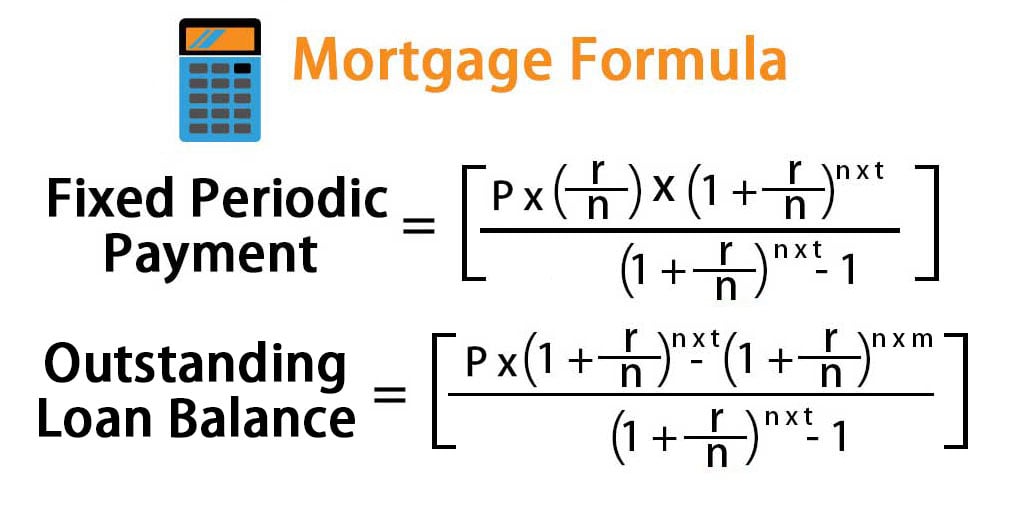

Mortgage Formula Examples With Excel Template

How Much House Can You Afford Readynest

Profit Vs Income 5 Most Valuable Differences To Learn

Komentar

Posting Komentar